After a strong run in the first ten months of 2025, global stock markets slowed in November. This was despite a robust earnings season and rising hopes for a United States (US) interest-rate cut in December. Although an end to the longest-ever US government shutdown on record (43 days) brought some relief, market uncertainty around economic data and the impact on growth, as well as monetary policy, resulted in a slightly more toned-down approach to risk assets.

The tech sector was especially disliked during the month, with not even better-than-expected results from NVIDIA able to allay concerns about high valuations and overly optimistic expectations for the artificial intelligence (AI) theme.

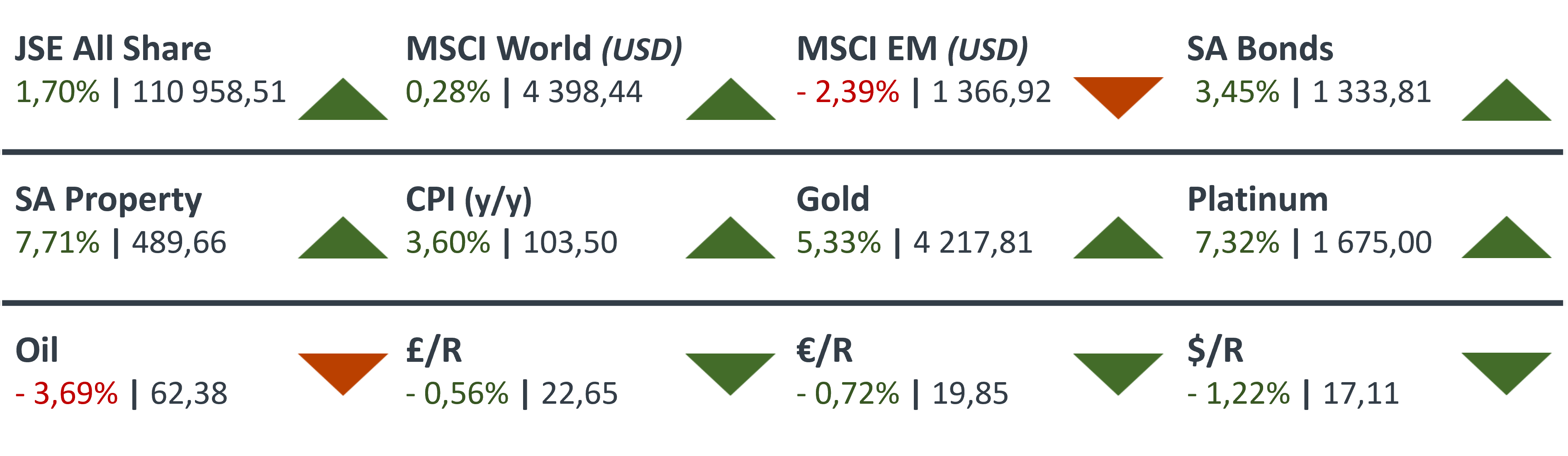

Despite a 4% rally in the last few days of November, stocks in developed markets rose by just 0.3% for the month, now up 20.6% for the year thus far. Emerging markets (EMs) underperformed in November, primarily owing to detractions from some of the tech-heavy countries, such as Korea and Taiwan. Despite this underperformance, EM equities remain comfortably ahead of their developed peers year-to-date, up 30.4%.

The Johannesburg Stock Exchange was one of the best-performing global stock markets in November, while also being one of the best-performing equity indices year-to-date (in USD terms). One of the big events for the month was the Medium-Term Budget Policy Statement, perceived as relatively market-friendly, with a focus on fiscal discipline. The disciplined budget and lower inflation target, along with tame inflation data, provided enough scope for the South African Reserve Bank to cut rates by 0.25%.

Other notable highlights for the month included:

- NVIDIA reported stellar results: The world’s most valuable company announced better-than-expected results for its most recent financial quarter, with revenue up 62% over the year, and a guidance upgrade for the coming financial quarter, anticipating sales of approximately $65 billion worth of computer chips.

- South African bond yields continued to fall: The South Africa 10-Year Government Bond Yield ended the month at 8.5%, its lowest rate in almost five years.

- Alphabet’s Gemini 3 challenged ChatGPT: Shares in Alphabet rose sharply during November, as industry data suggested its latest AI release (Gemini 3) was more capable than competitor offerings.

- Precious metals returned to gains: Precious metal miners returned as the key drivers of local equity returns, with gold and platinum miners up 13% on average, as gold and platinum prices both rallied approximately 6% for November.

Thank you for your trust and support during 2025. We wish you and your loved ones Happy Holidays, and look forward to our continued partnership with you on your journey to financial well-being!